How do Net Zero committed asset owners use their proxy votes?

Preliminary insight into voting patterns of members of the UN-convened Net-Zero Asset Owner Alliance (NZAOA) shows leaders and laggards.

Lauren Chin, University of Edinburgh

Theodor Cojoianu, University of Edinburgh

Andreas Hoepner, University College Dublin

Diana Moreno, Sociovestix Labs

Richa Patil, Sociovestix Labs

Anh Vu, Queen’s University Belfast

*authors in alphabetical order by last name

For media/communications: Jacey Bingler

Senior Communications Campaigner

jacey.bingler@sunriseproject.corg

For blog post content: Minyoung Shin

Senior Strategist, Global Sustainable Finance

minnie.shin@sunriseproject.org

Asset owners play a significant role in pushing companies to accelerate climate action, both through championing environmental, social, and governance (ESG) factors in their investment decisions (e.g. asset allocation), as well as through active ownership (e.g. proxy voting). In December 2021, we released our first report on the members of the UN-convened Net-Zero Asset Owner Alliance (NZAOA, also referred to as “the Alliance” interchangeably in this piece). One year later, we examined whether or not NZAOA members have become more progressive on climate voting than non-NZAOA peers.

In this preliminary piece, which focuses on the climate voting results, before publication of the extensive research later this year, we find there are some positive improvements in the climate voting behavior of NZAOA members. However, overall we find that joining the NZAOA does not result in improving members’ climate voting behavior. Additionally, when it comes to supporting climate proposals that require tangible action such as prohibiting new coal fired power generation or denying new fossil fuel finance, NZAOA members hesitate to show leadership and do not vote in line with their net zero commitments.

Recap of 2021 Findings

In our 2021 analysis of 46 asset owners in the NZAOA, we found only 28% directly exercised their share voting rights on climate-related shareholder proposals. Statistical regressions revealed that NZAOA membership did not correlate with an increase in direct pro-climate voting compared to peers with similar commitments in the UN Principles for Responsible Investment (PRI). Using data from PRI reports and Insightia, we found transparency levels with respect to voting practices of NZAOA members were very low. While asset owners in the Alliance were more likely to vote in favor of climate resolutions as a whole, they did not support more ambitious climate resolutions that called for Paris-aligned strategies as compared with those not in the Alliance.

Key Takeaways from 2022 Climate Voting Findings

In our 2022 preliminary update, we examined 73 members of the NZAOA. Among the 73 members, only 19 NZAOA members have observable votes before and after signing up to the Alliance. We analyzed their climate voting performance while comparing them to identified PRI membership peers as of September 2022 using data from Insightia. Research conducted thus far shows that:

- NZAOA members did not show consolidated leadership in supporting climate resolutions that call for an end to financing new fossil fuel supply. There’s a notable lack of support from several players with larger voting shares.

- As a whole, NZAOA members are more likely to vote “for” climate-related proposals than PRI peers;

- However, similar to last year’s result, we find that joining the NZAOA does not result in asset owners improving their voting in favor of climate resolutions more than PRI peers in the non-NZAOA group.

- NZAOA members still favor disclosure-oriented climate proposals over proposals that request alignment or action with science-based targets.

- When we only look at the founding members of the NZAOA, we find that they are 29% less likely to vote in favor of climate-related proposals compared with their PRI peers after they established the Alliance.

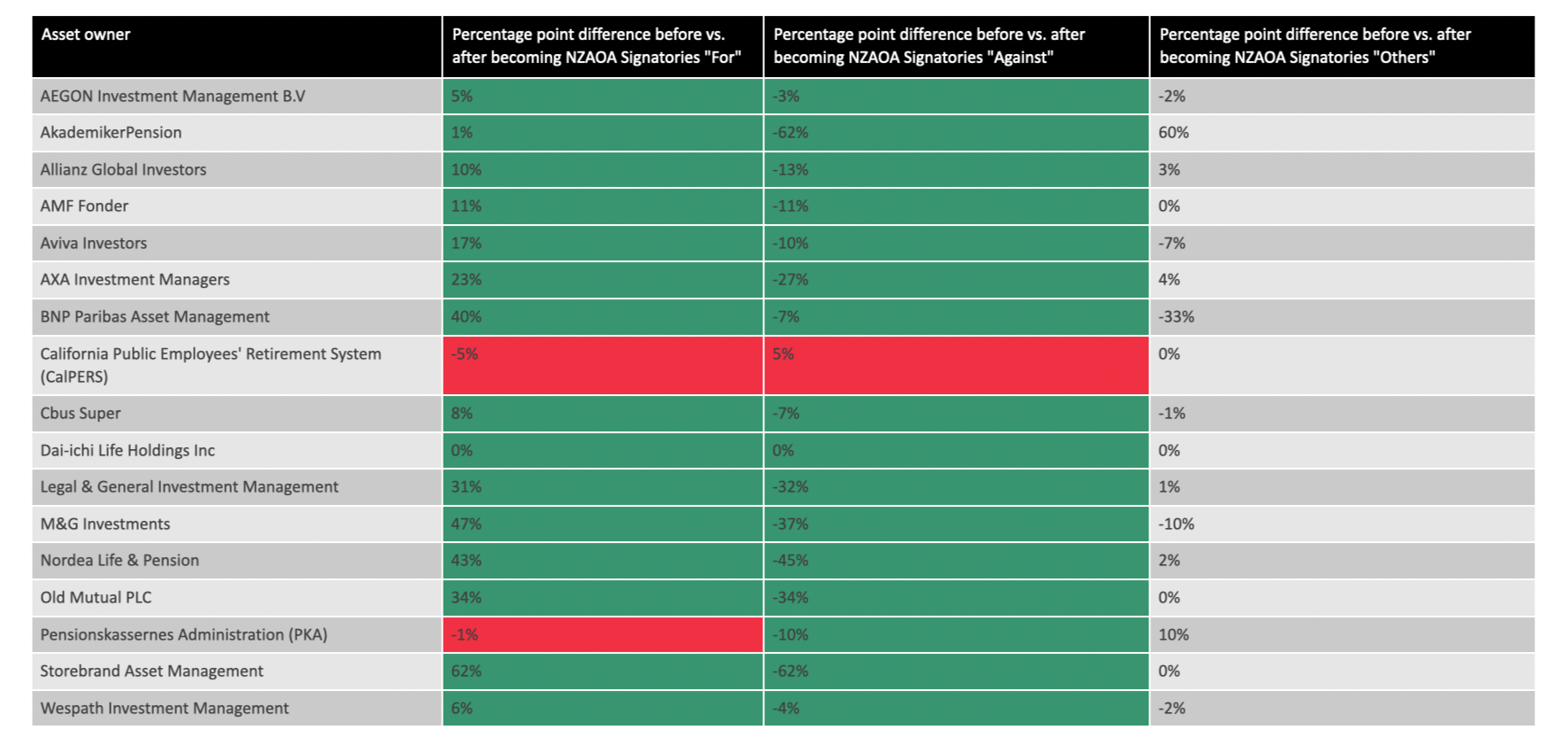

- On ambitious proposals calling for companies to change their business models to align with the Paris Agreement, all NZAOA signatories improved their voting performance after joining the NZAOA–except for the US California state pension fund, CalPERs.

Smaller investors, such as Swedish pension fund AMF showed leadership on voting that far outweighed actions from some of the larger asset owners in the NZAOA.

Methodology

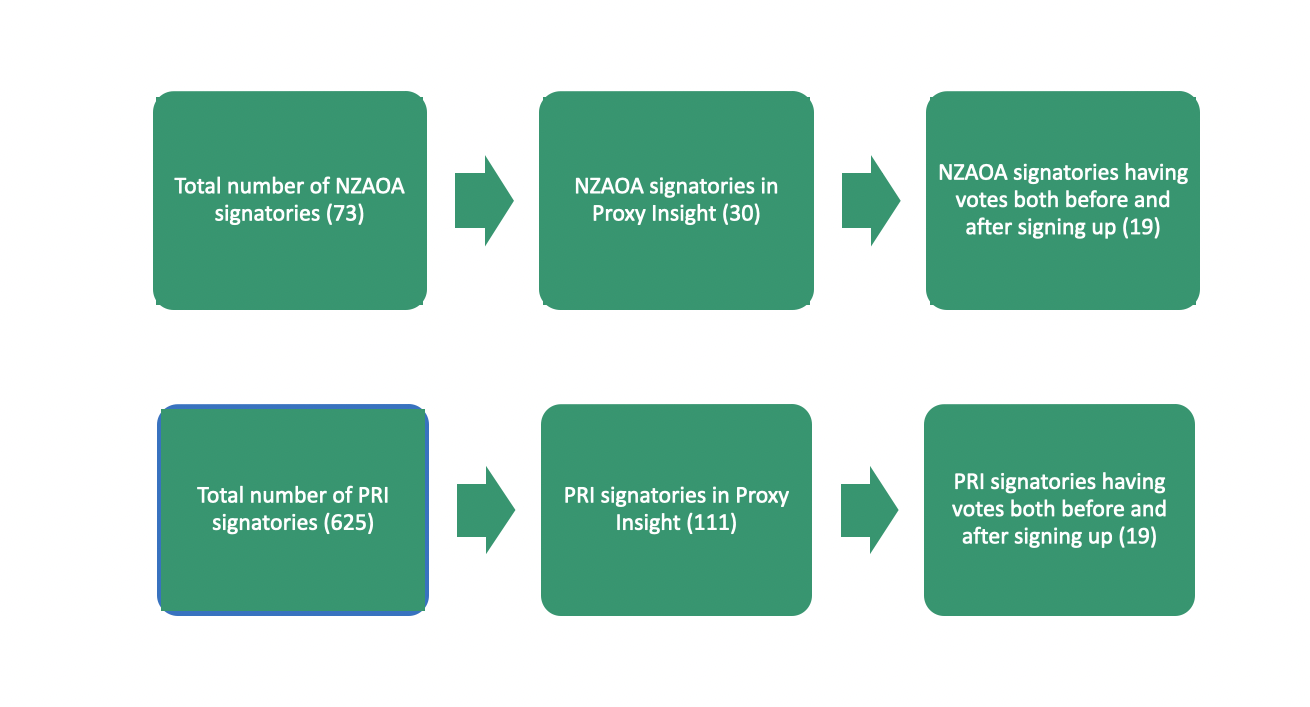

In this year’s data refresh, we added approximately one more year of voting data from Insightia, with increased data availability of asset owner voting behavior before and after committing to align their investment portfolios with climate goals. We analyzed 19 NZAOA members and corresponding PRI (non-NZAOA) peers, chosen based on assets under management (AUM) and the country of headquarters (see Figure 1 for how target asset owners were selected). As with last year’s methodology, internal asset manager voting records were used to represent asset owner votes due to the possibility that asset managers may be voting for other clients and because asset owners are not directly visible in Insightia.

Figure 1. Filtering process of asset owners from Insightia

Figure 1. Filtering process of asset owners from Insightia

On the statistical modeling side, results from both logistic regression models and difference-in-difference models are closely similar to last year’s. However, in the report this year, via a difference-in-difference model, we also highlight voting patterns of NZAOA founding members where we can observe both votes before and after they establish the NZAOA. These members are AMF, Alecta, Allianz, CalPERS, Caisse de depot et placement du Quebec (CDPQ), Nordea Life & Pension, and Storebrand.

Analysis Results

1. As a whole, NZAOA members are more likely to vote “for” on climate-related proposals than PRI peers. However, similar to last year’s result, we find that after signing-up to the NZAOA initiative, NZAOA members’ increase in pro-climate voting is not statistically different to that of non-NZAOA peers.

First, we ran logistic regressions for the whole sample and then on each of the nine resolution categories. The results show that as a whole, NZAOA members are more likely to vote “for” on climate-related proposals than non-NZAOA peers. The coefficient for being a NZAOA member means that the odds for NZAOA members voting in favor of climate action are about 73% higher than the odds for non-NZAOA peers.

Second, we ran difference-in-difference regressions for the whole sample, for each type of resolutions, for the subsample of matched peers, and for the subsample of seven NZAOA founding members.

The treatment effect coefficients (i.e. being an NZAOA member and votes after joining the alliance) are all negative across three different samples (i – whole sample, ii – matched subsample, and iii – subsample containing votes of the seven NZAOA founding members and their PRI peers), which further corroborates the finding that after signing-up to the NZAOA initiative, the NZAOA members’ increase in pro-climate voting is not statistically different to that of the non-NZAOA peer group.

Figure 2: How NZAOA and PRI (non-NZAOA) members vote on climate-related issues over time (30 NZAOA members and 111 PRI counterparts)

Figure 2: How NZAOA and PRI (non-NZAOA) members vote on climate-related issues over time (30 NZAOA members and 111 PRI counterparts)

2. US pension fund CalPERs falls behind the pack as the only investor that did not improve on proposals that call for Paris-aligned strategies after joining the NZAOA.

There is a notable positive highlight for NZAOA members in terms of their voting patterns on proposals that call for Paris-aligned strategies. Out of more than 20,000 votes in the dataset, we classify around 25% as ambitious (i.e. calling for companies to change their business models to align with the Paris Agreement). On these proposals, there are 17 NZAOA signatories whose votes we can observe before and after they join the Alliance. All these asset owners improve their voting performance after becoming a member except for CalPERS, who drags the overall voting performance down.

Table 1. After vs. Before votes of matched NZAOA members on ambitious climate-related resolutions that might call for Paris-aligned strategies

3. Overall, investors still favor disclosure-oriented climate proposals over proposals that request alignment or action with science-based targets.

Analyzing 2,774 environmental proposals in the 2022 time period, investors voted in favor of climate resolutions three out of four times. However, when closely examining the data, we found a significant gap in support between disclosure-oriented and alignment-oriented (i.e. alignment and action with science-based targets) proposals when coding using Climate Action 100+ benchmarks. While asset owners voted in favor of disclosure-oriented proposals 88% of the time, there was a notable decrease in support for alignment-oriented proposals with NZAOA members only voting in support 62% of the time.

Figure 3. NZAOA member voting on disclosure-oriented vs. alignment-oriented climate proposals

Figure 3. NZAOA member voting on disclosure-oriented vs. alignment-oriented climate proposals

We theorize this is because disclosure measures are largely low-hanging fruit. While it is indeed important to measure environmental impact and report them in a scientifically-sound method, there remains a significant portion of alignment-oriented votes that address continued damage to the environment which lack support, e.g. striving for decarbonization through prohibiting new coal fired power generation.

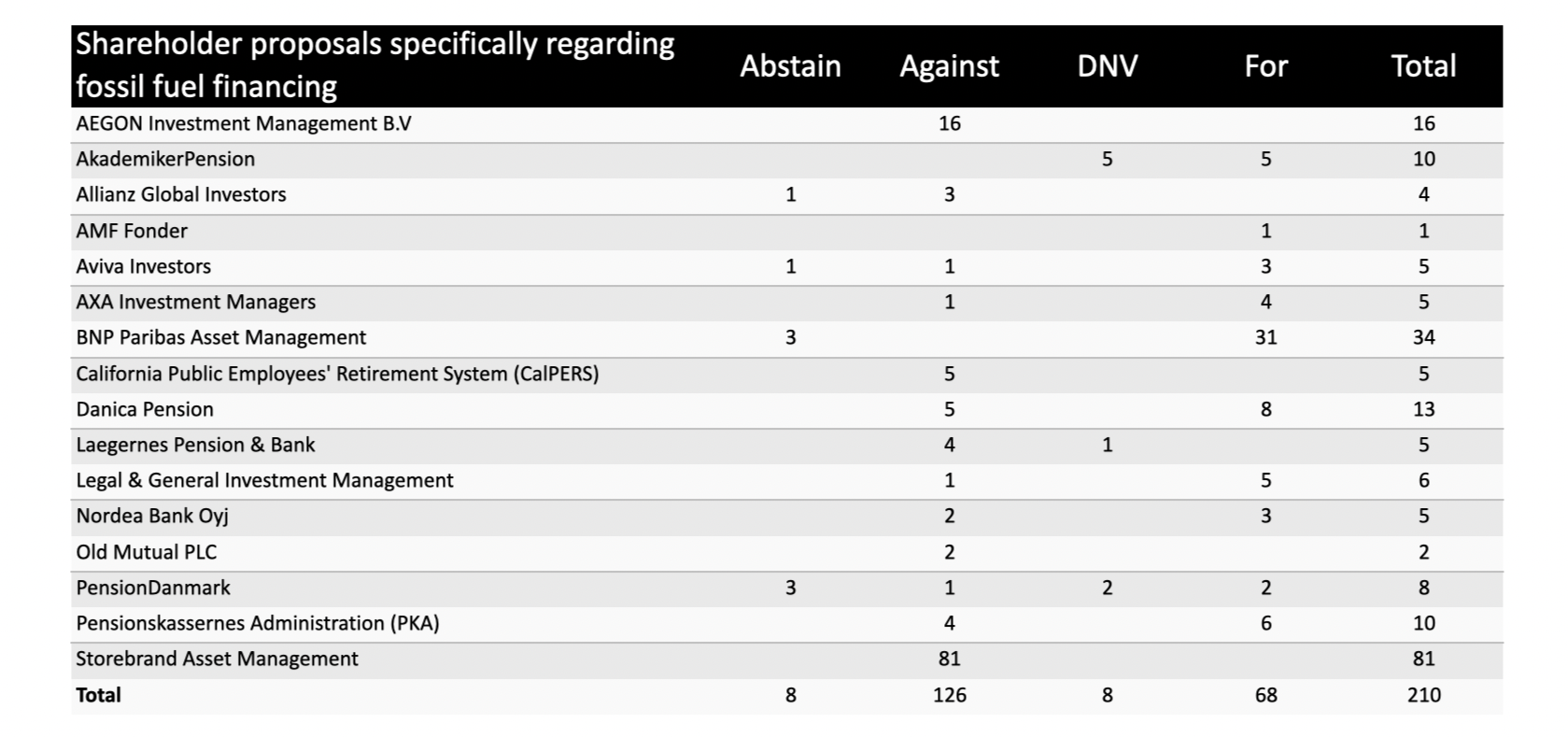

4. Several members of the NZAOA fail to show leadership in supporting climate resolutions that call for an end to financing new fossil fuel supply in line with 1.5℃.

In January 2022, NZAOA took a firm stance on fossil fuel financing in the 2nd Target Setting Protocol, which required members to “support the phase-out of fossil fuels required by 1.5℃ scenario” and “not provide new finance to infrastructure assets whose purpose or emissions cannot be aligned with the Alliance net-zero ambitions” referencing the International Energy Agency’s (IEA) Net Zero by 2050 (NZE2050) scenario and the One Earth Climate Model (OECM) as the latest climate science to follow.

However, taking a closer look at specific resolutions on ending fossil fuel financing in line with science-backed Net Zero by 2050 scenarios, we observed split results when looking specifically at NZAOA member voting. While 10 out of 16 NZAOA members showed full or partial support for passing these resolutions, several players with larger voting shares across multiple funds voted against proposals in a disappointing lack of support. This stark result shows that some NZAOA members have yet to follow through on the ambition of the Alliance and calls for the NZAOA to require members to prioritize engagement with the facilitators of fossil fuel expansion including banks and insurers.

Table 2. Voting results on shareholder proposals on fossil fuel financing

Table 2. Voting results on shareholder proposals on fossil fuel financing

We also find that investors generally voted more favorably for other resolutions that requested CapEx alignment with net zero targets or scenarios and lobbying expectations in comparison to resolutions on fossil fuel expansion.

5. Founding members of the NZAOA are 29% less likely to vote in favor of climate-related resolutions compared with PRI peers after they established the Alliance.

A deep dive into voting patterns of NZAOA founding members whose votes we can observe from the Insightia dataset shows an underperformance by these signatories. The corresponding difference-in-difference coefficient is statistically significant and negative, which means that the founding members of NZAOA are 29% less likely to vote “for” on climate-related proposals as compared with the seven PRI members after they established the Alliance. The statistical result is not surprising given the descriptive statistics on votes before and after of NZAOA members (Table 3), especially votes by CDPQ and CalPERS.

Table 3. After vs. Before votes of matched NZAOA members on climate-related resolutions (comparison of the counts of for, against, and other votes by NZAOA members before and after the member date of each NZAOA member)

Table 3. After vs. Before votes of matched NZAOA members on climate-related resolutions (comparison of the counts of for, against, and other votes by NZAOA members before and after the member date of each NZAOA member)

Moreover, founding members such as CalPERS and Allianz leveraged their voting share rights in ways that sent mixed messages about their climate commitments. Despite making high level statements about commitments to net zero, both did not support any “no fossil fuel expansion” proposals (see Table 2). CalPERS, PKA, and LGIM also voted against a resolution that called for moving away from new coal through prohibiting new coal fired power generation–ignoring the directive to align internal coal phase out policies with the NZAOA’s published Thermal Coal Position.

Notwithstanding some poor performers bringing down the overall membership voting profile, there were some investors who voted overwhelmingly in favor of resolutions that would achieve the NZAOA’s stated goals. AMF pension fund in Sweden with $65bn AUM showed decisive leadership and voting that far outweighed actions from some of the larger asset owners in the NZAOA. Despite the smaller voting influence it wields, AMF voted in favor of 100% of all environmental proposals visible in Insightia.

Conclusion

With increasing recognition of the important role asset owners play in driving decisions of today that build the world of tomorrow, there is a need for both transparency and scrutiny of investor-led net zero alliances such as the NZAOA to ensure they deliver on their promises. Ahead of COP27 and one year after our first report, this preliminary research sheds light on how committed the NZAOA members are to climate stewardship pledges. Our analysis continue to show that being part of the NZAOA does not result in asset owners voting more in favor of climate resolutions. While this year’s analysis shows some positive efforts, we also identified that NZAOA members are not stepping up to vote ambitiously on alignment or action-oriented climate resolutions and resolutions that call for an end to fossil fuel supply in line with 1.5℃. We also observe key laggards among the founding members that are not progressing on their climate voting practice upon establishing the Alliance.

Exercising their voting rights is a critical part of asset owner stewardship and allows investors to have direct influence over a company’s management and operations. However, as we see from this analysis, few asset owners exercise their voting rights directly and instead, delegate this responsibility to external managers. The upcoming report seeks to expand further on the asset owner’s climate stewardship and will assess how net zero committed asset owners address engagement with asset managers and bondholdings.